Private Money Lending Process in the UAE

UAE’s fast-paced economy thrives on unique opportunities and many businesses and individuals often get hampered with the complex traditional bank loans. Having a lengthy approval time or eligibility criteria disrupts the accessibility of a loan. Whether it is some entrepreneur seeking quick cash or any investor looking for flexible financing, these private money lenders play a huge role in bridging these different financial gaps. These personal loans are both convenient and efficient.

However, with such money lending activities, you can face unforeseen risks. Besides a few registered private money lenders in the UAE, there are also private lenders for personal loans. These private money lenders have operated for years in the UAE, providing fast and flexible financial solutions to those struggling with traditional banking requirements. In this article we will look in-depth at private money lenders in Dubai with the benefits and the risks involved.

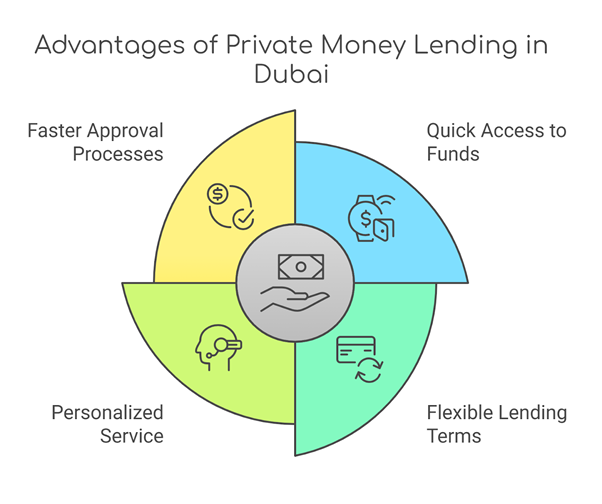

Benefits of Private Money Lending in Dubai

A significant benefit of private money lending is that the loan amount is often available much faster than through traditional financial institutions. The approval process is also streamlined in the UAE using private lenders for personal loans. Private money lenders play a crucial role in Dubai’s economic ecosystem. However, only a minority of people depend on them. These are the major benefits of private money lenders in Dubai.

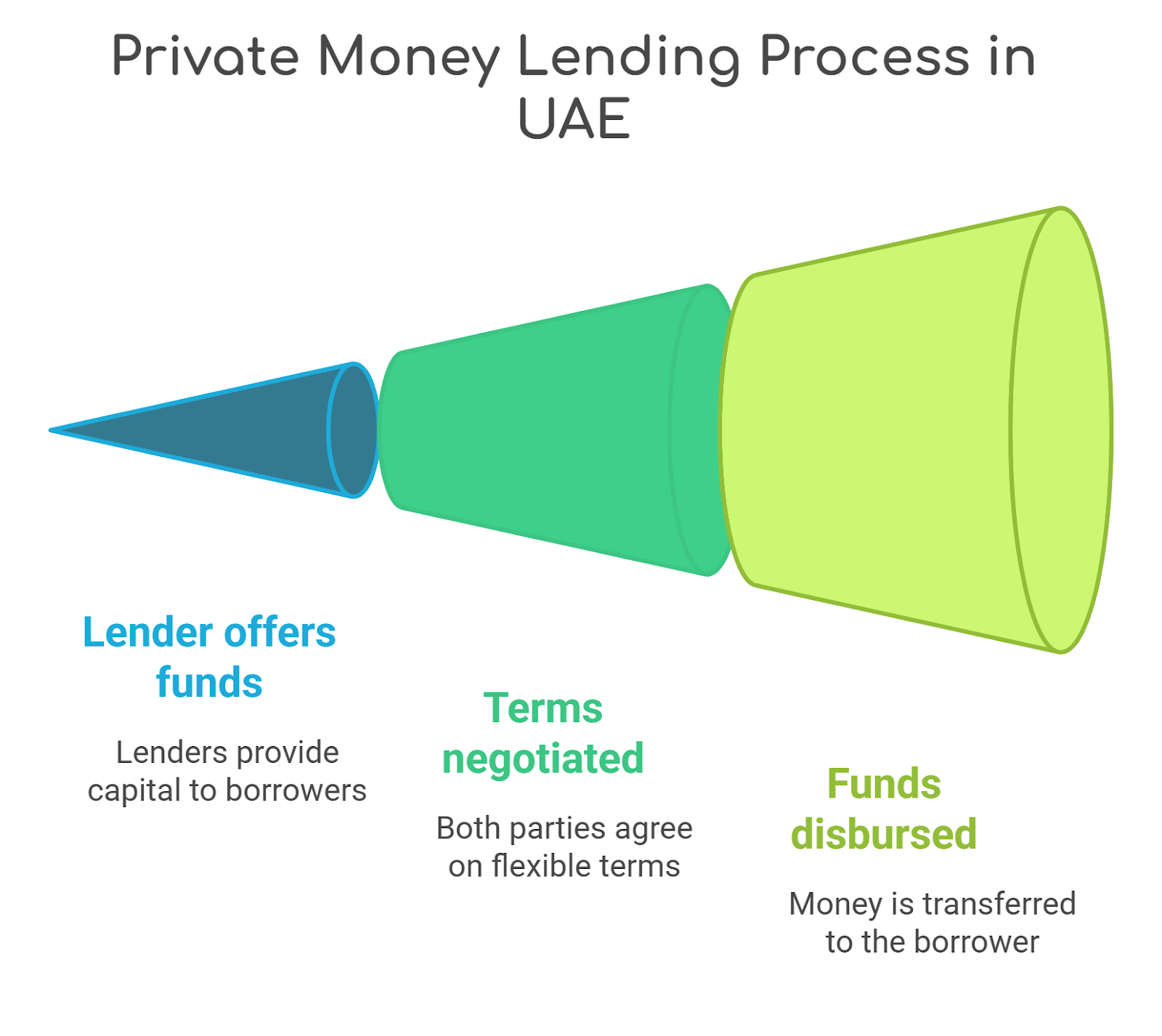

Private Money Lending Work in the UAE

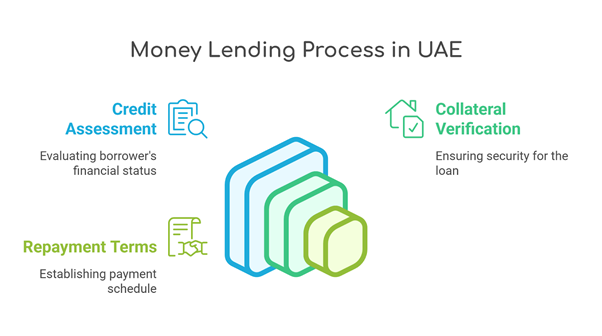

Understanding the money lending process will be crucial for borrowers in Dubai. This sort of personal lending operates as an alternative to traditional bank loans. These private money lenders in Dubai work independently, offering faster approval and flexible terms. Always verify the lenders before any form of financial proceedings. There are two types of private money lenders in the UAE :

UAE’s private money lending process is largly identical to the other loan process available in this country. There are multiple things you can do after getting approved by the private lender, you can consolidate your remaining debt, buy valuable properties, make significant home improvements and other things. However, you can use the funds to cover your unexpected expenses and enhance your financial stability in the future.

>

>

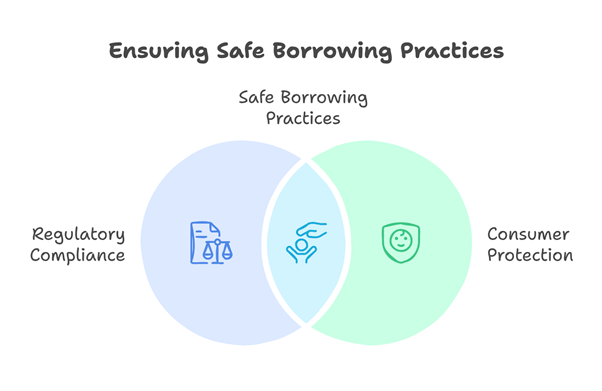

Ensuring Safe Borrowing Practices in the UAE

Many private lenders in UAE are offering legitimate loan services, but borrowers in the UAE should exercise caution and verify the lender’s credentials before making any financial decisions. Unlicensed money lending is a punishable offence in the UAE as per their constitution (Article 458 and Article 459). Most private money lenders in Dubai operate within the legal framework. These lender’s legitimacy depends on whether some financial institutions, like UAE Central Bank and others licence them.

Ensuring a safe borrowing experience takes proper research and effort, and you can work with registered financial institutions and review all terms carefully before committing to any form of loan. Legal private money lenders in Dubai provide formal loans, agreements, and clear repayment options and adhere to UAE consumer protection laws.

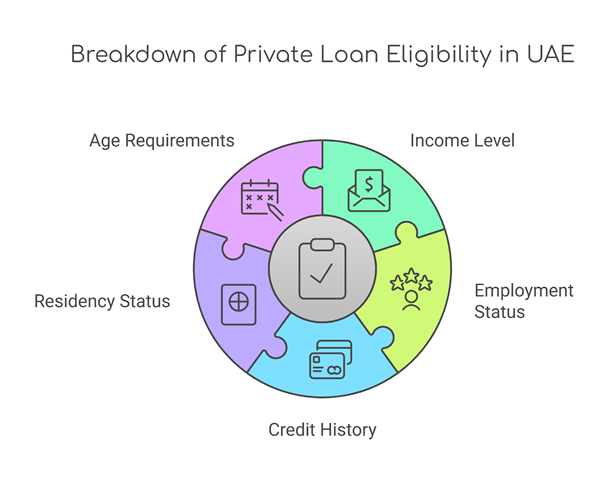

Eligibility Criteria for Private Lending in Dubai

Private money lenders are offering an alternative option to traditional financing in the UAE. Getting approval from these lenders is not quite simple. Some lenders are following specific criteria to assess borrowers’ overall creditworthiness by evaluating their financial profile, repayment capacity, and other criteria. However, private money lenders in the UAE are providing flexible terms to some borrowers.

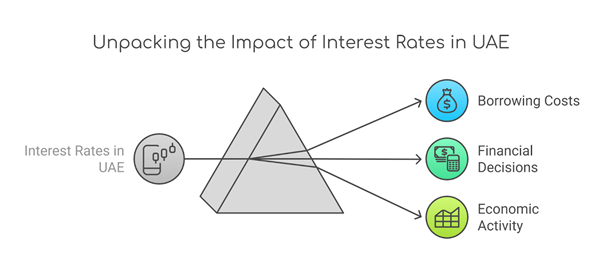

Interest Rates of Private Lending in UAE

Interest rates are consequential concerns when taking loans from the private money lenders for your specific needs. Depending on your loan structure, private money lenders may charge between 10% and 30% annually. However, short-term emergency loans or high-risk unsecured loans may come with recurring monthly interest rates ranging from 2% to 5%, which can quickly add up after a certain period. Other private money lenders in the UAE may apply flat-interest rates.

You should consider comparing multiple lenders, as private lending is less regulated than banking. Interest rates can vary drastically when private money is lent. Reputable lenders will clearly break down their interest rates, fees, and repayment schedules. However, higher interest rates demand careful financial planning and sound knowledge. Constantly assess the affordability of your loan before taking on loans to avoid potential financial strain.

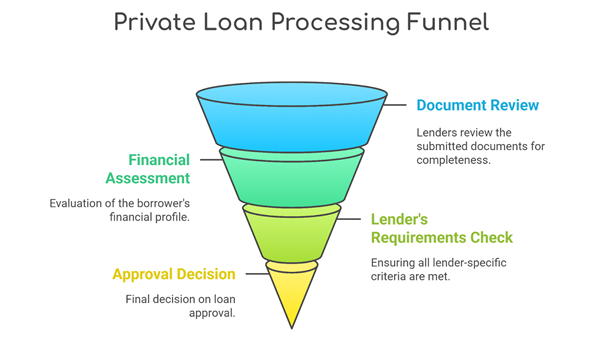

Private Loan Processing Funnel in UAE

One of the most significant advantages of borrowing money from private money lenders in the UAE is the faster processing time compared to traditional financial institutions. Conventional banks require weeks to approve any loan due to their strict documentation and creditworthiness. Private money lenders in Dubai offer much quicker turnaround, often approving such loans within a few days or even hours. Multiple key factors can affect loan processing time:

Getting a quick loan can provide immediate relief, and it is quite essential to find a balance between processing speed with financial responsibility. Always ensure your own repayment terms that align with your budget.

Financial Services Landscape in Dubai

These are some trustworthy private finance companies in the UAE :

When seeking private financing in the UAE, it’s crucial to engage with licensed or reputable financial institutions to ensure compliance. Engaging with any licenced financial institution ensures that you are willing to deal with entities that adhere to regulatory standards set by the UAE authoritative bodies.

What precautions should be taken before borrowing from private lenders in Dubai

Borrowing from private money lenders in the UAE has risks that should not be ignored. These private money lenders can be the quick solution when traditional banks are not operating in a fast-paced environment. Before taking out loans from these private moneylenders, it is essential to consider potential pitfalls to avoid any financial mishaps. These are the significant loopholes in private financing in the UAE:

Taking private loans can be helpful if you are being responsible for it. Always weigh your present options, stay informed, and ensure you deal with a legitimate private lender before committing. Verifying the lender’s license of your lender is mandatory. Compare offers from multiple lenders to avoid excessive rates, read the fine print, and understand all of the terms before taking on your loan.

Taking personal loans from private money lenders will risk your financial situation, and you should be aware of the legal terms and regulations in the UAE. Only a few legal lenders in Dubai provide money within legal terms and conditions. Before taking any form of loan, you should work on your overall credit score and source of income. Taking a private loan can be helpful only if you’re considering such loans under legal terms in the UAE.

Private money lenders in Dubai are non-bank financial institutions or individuals who offer quick loans with flexible terms, often with minimal documentation and faster approvals compared to traditional banks.

Yes, but only licensed private lenders are legal in the UAE. Borrowers should ensure that the lender is registered with the UAE Central Bank or other financial regulatory authorities to avoid legal issues.

● Faster loan approvals

● Minimal documentation requirements

● Flexible loan terms

● Loans available for individuals with low credit scores

● Custom repayment options

● Higher interest rates compared to banks

● Shorter repayment periods

● Potential hidden fees and charges

● Risk of dealing with unlicensed lenders

Check if the lender is registered with the UAE Central Bank or a recognized financial authority. Always ask for proper documentation and avoid lenders who operate without contracts or formal agreements.