Owning a home in any country is a dream for many. When you are applying for a mortgage, it’s essential to understand the eligibility criteria set by the financial institution in the UAE. Your income is crucial to calculate home loan eligibility, loan amount, and repayment terms, as it may affect the interest rates and loan tenure and home finance eligibility in the United Arab Emirates.

Each bank or private lender in the UAE has different salary or income requirements. You can get home loans from multiple sources, and focusing on your income and credit score is crucial. However, some financial institutions offer options for lower-income applicants with rigid terms. Understanding these aspects will help you plan your finances and improve your chances of securing a secure mortgage with favourable terms.

Buying a home is a significant milestone, whether it’s your first property or an investment for the future. If you are considering applying for a home loan in the UAE, navigating the eligibility requirements can initially feel overwhelming. Think of the process as preparing for a big trip—there’s paperwork, financial checks, and non-negotiables before you board the flight to homeownership.

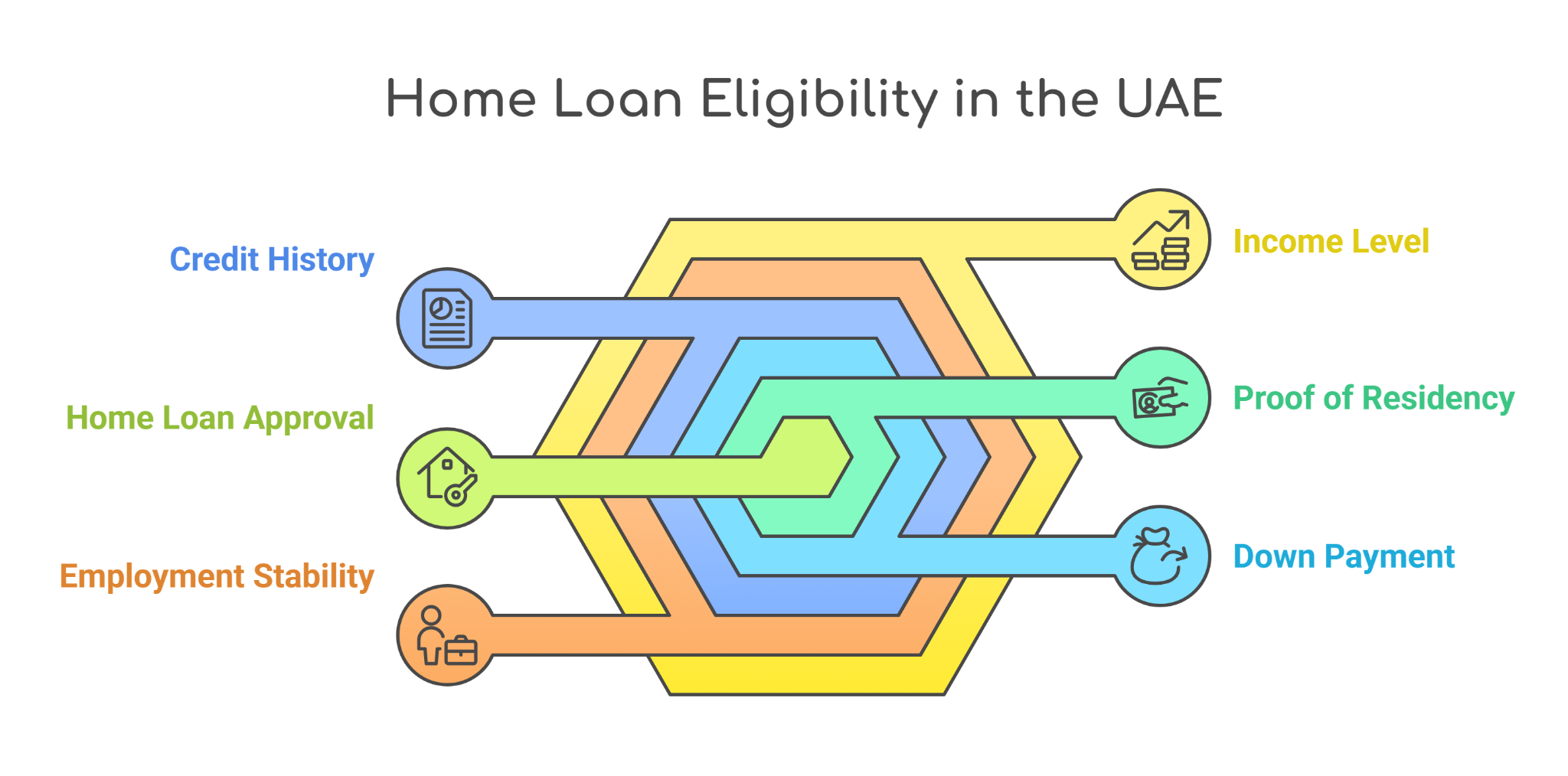

The first checkpoint is understanding the qualifications for a home loan in the UAE. Conventional banks offer mortgages to both residents and non-residents, but the criteria may differ. One key factor is the minimum salary for home loan in UAE, as most banks require a stable income. Typically, salaried employees need a minimum monthly income of AED 10,000. Additional requirements include:

Minimum age : 21 years

Employment history : At least six months in your current job or one year of total work experience

Good credit history : A strong credit score to enhance approval chances

For non-residents, the home finance eligibility threshold is higher. Lenders often require a larger down payment, typically 25-50% of the property value. Additionally, the documentation process can be more detailed, especially if your income comes from outside the UAE.

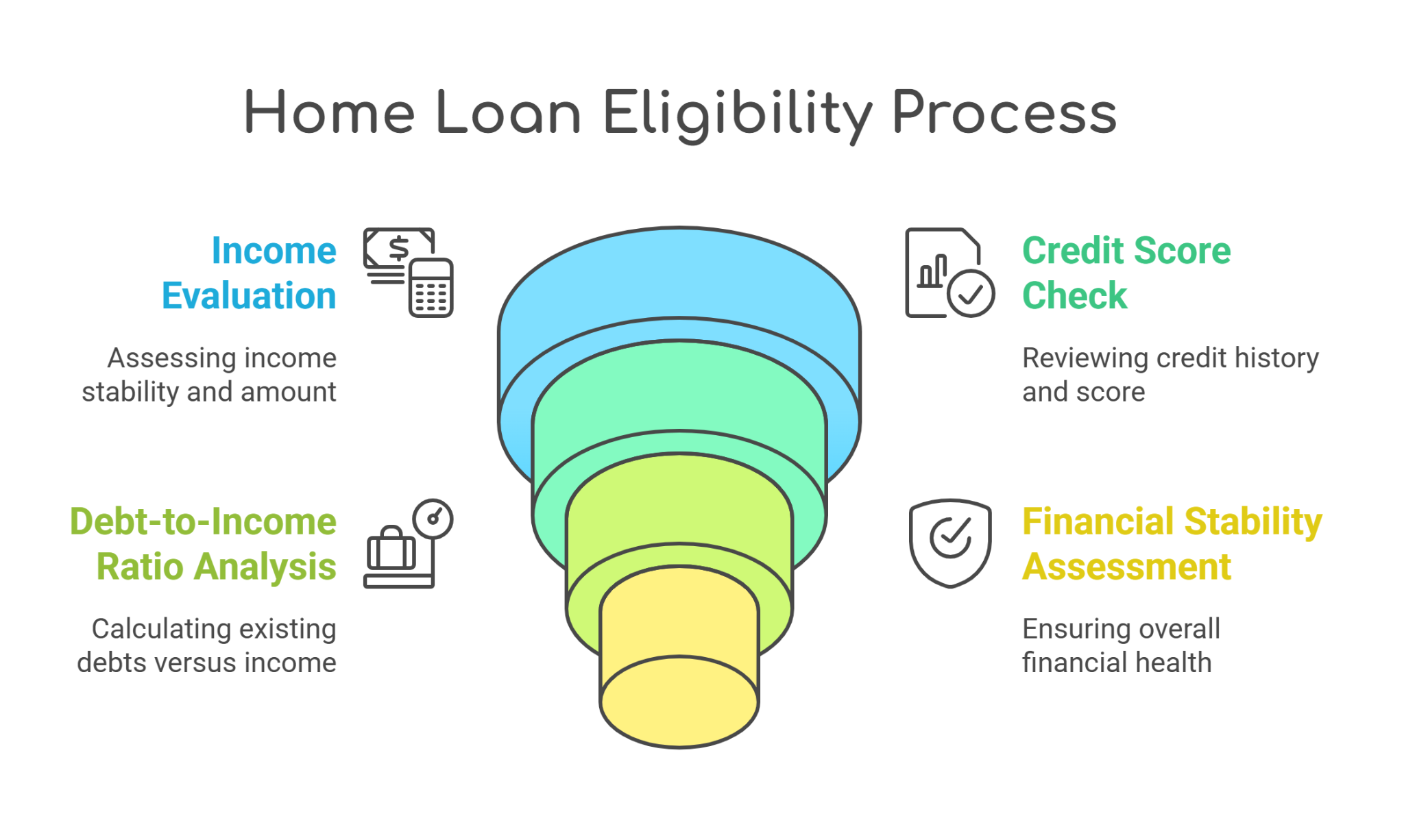

How to calculate your home loan eligibility in the UAE

Traditional banks in the UAE follow the Debt Burden Ratio (DBR) rule, which limits your monthly loan repayments (including other loans and credit card payments) to 50% of your monthly income. For instance, if you earn AED 20,000 per month, your total loan repayments should not exceed AED 10,000.

If you’re unsure about your borrowing capacity, you can use a home loan eligibility calculator to estimate your loan amount based on your income, expenses, and existing liabilities. This tool helps manage finances and make informed decisions before applying for a mortgage.

Currently, 100% home financing is not available in the UAE. Buyers must contribute a minimum down payment based on residency status and minimum salary for home loan eligibility:

By understanding these factors, you can assess your eligibility and secure the best home financing option in the UAE.

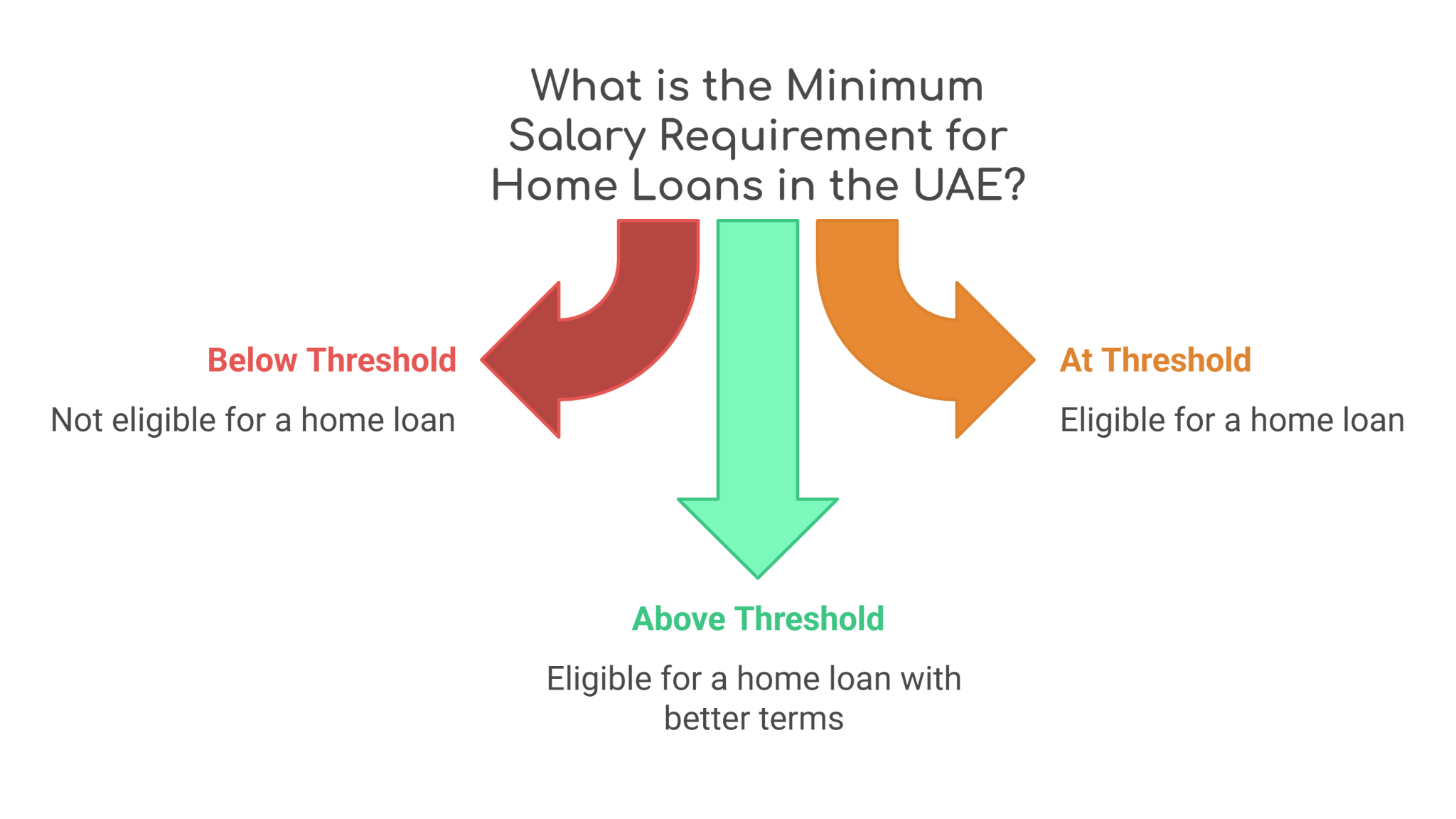

What is the Minimum Salary Requirement for Home Loans in the UAE

Think of the minimum salary for a home loan in UAE as the financial institution’s way of ensuring that you can comfortably handle your monthly repayments without sacrificing your current lifestyle. However, nobody wants to move into their dream home only to struggle with the bills every month.

Most banks in the UAE have officially set the minimum salary for home loan in UAE between AED 10,000 to AED 15,000 for salaried employees. However, some banks might offer home loans to individuals earning as little as AED 7,000, though these deals often come with higher interest rates and stricter terms. If you are self-employed and lack proper income proof, the minimum salary requirement can go up to AED 25,000 per month, as your income is considered less predictable.

Your home finance eligibility is not just about how much you earn—it depends on stability and consistency. Below are key factors that influence eligibility :

Job Stability : Lenders prefer applicants who have been with their current employer for at least six months.

Employment Type : Salaried individuals with stable jobs are more likely to qualify for a home loan, whereas self-employed individuals need to provide higher income proof.

Loan-to-Value Ratio : Some banks offer up to 80% financing for UAE nationals and 75% for expats. A strong and steady income can improve your chances of loan approval.

If you’re wondering how to calculate home loan eligibility, banks in the UAE assess several factors, including your monthly income, existing debts, and credit history. Many financial institutions also consider the Debt Burden Ratio (DBR), which ensures that your total loan repayments do not exceed 50% of your income.

A home loan eligibility calculator is a convenient tool that allows you to estimate how much financing you qualify for based on your income, expenses, and loan tenure. Most UAE banks provide online calculators to help you determine your borrowing capacity before applying.

By understanding these factors and using a home loan eligibility calculator, you can make a more informed decision about securing a home loan that aligns with your financial situation.

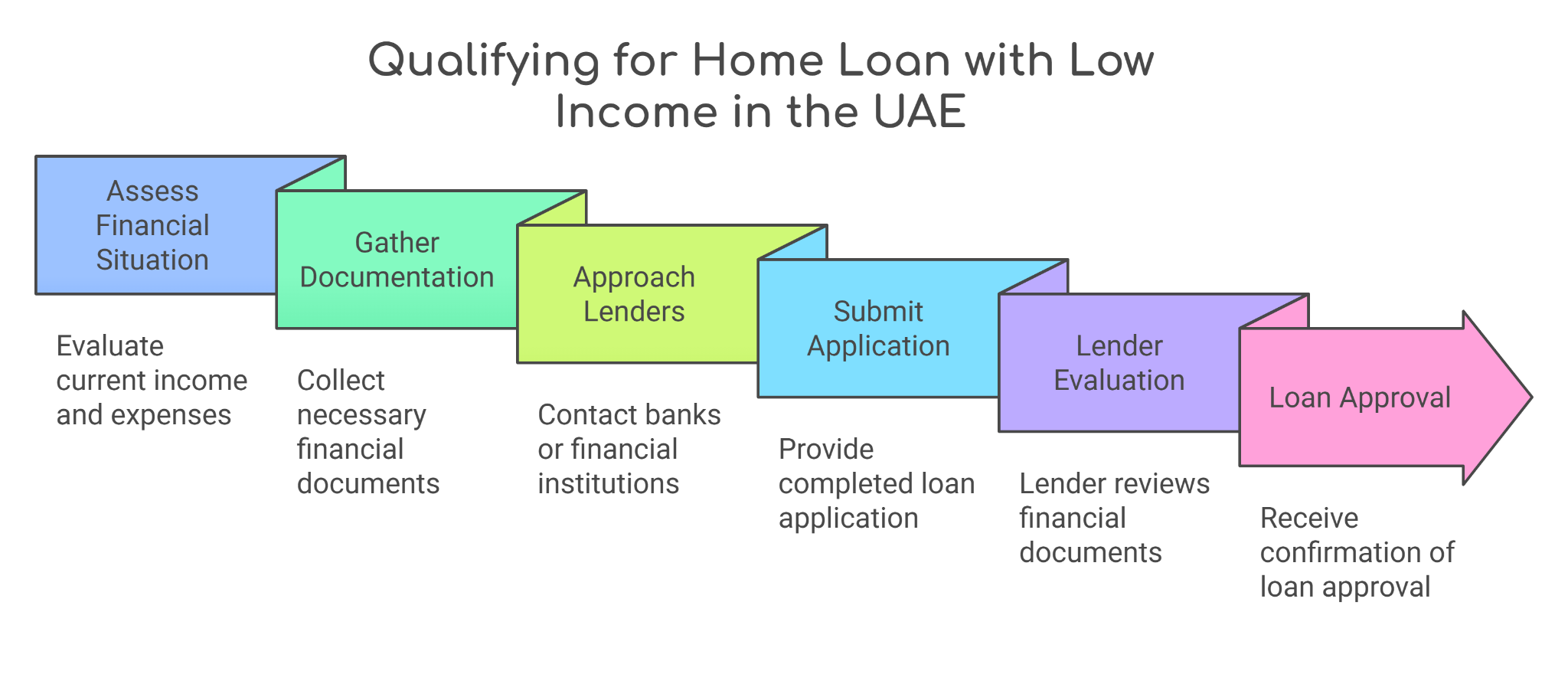

If your income is not strong enough to match the bank’s requirements and you opt for a home loan, you can apply with a co-applicant, as adding a spouse or close family member as a co-borrower will increase your overall eligibility. If your financial portfolio is well curated and you are willing to show multiple income sources, including rental incomes, investments, or other businesses, you will get approval.

Choosing a lower loan amount is smart; having a smaller home loan in the UAE may have more flexible salary requirements. However, having a good credit score enhances your loan approval chances by a significant amount. It is essential to compare different banks, understand hidden costs, and plan finances wisely before making a commitment. Remember, if you are considering buying a home in the UAE, you can start by evaluating your income, savings and long-term repayment ability to make an informed decision.

Home Loan Application Documents Required in the UAE

Understanding Home Loan Eligibility in the UAE

Applying for any home loan in the UAE can be an exciting yet overwhelming process. Whether you are a resident or an expatriate, banks require specific documents to assess your home finance eligibility. Meeting the minimum financial requirements and having all the necessary paperwork ready can streamline the application process and increase your chances of approval.

One of the key factors in home finance eligibility is income. Most banks in the UAE set a minimum salary for home loans in UAE at AED 10,000 per month, although this may vary depending on the lender and loan type. A higher salary improves your chances of approval and helps you secure better interest rates.

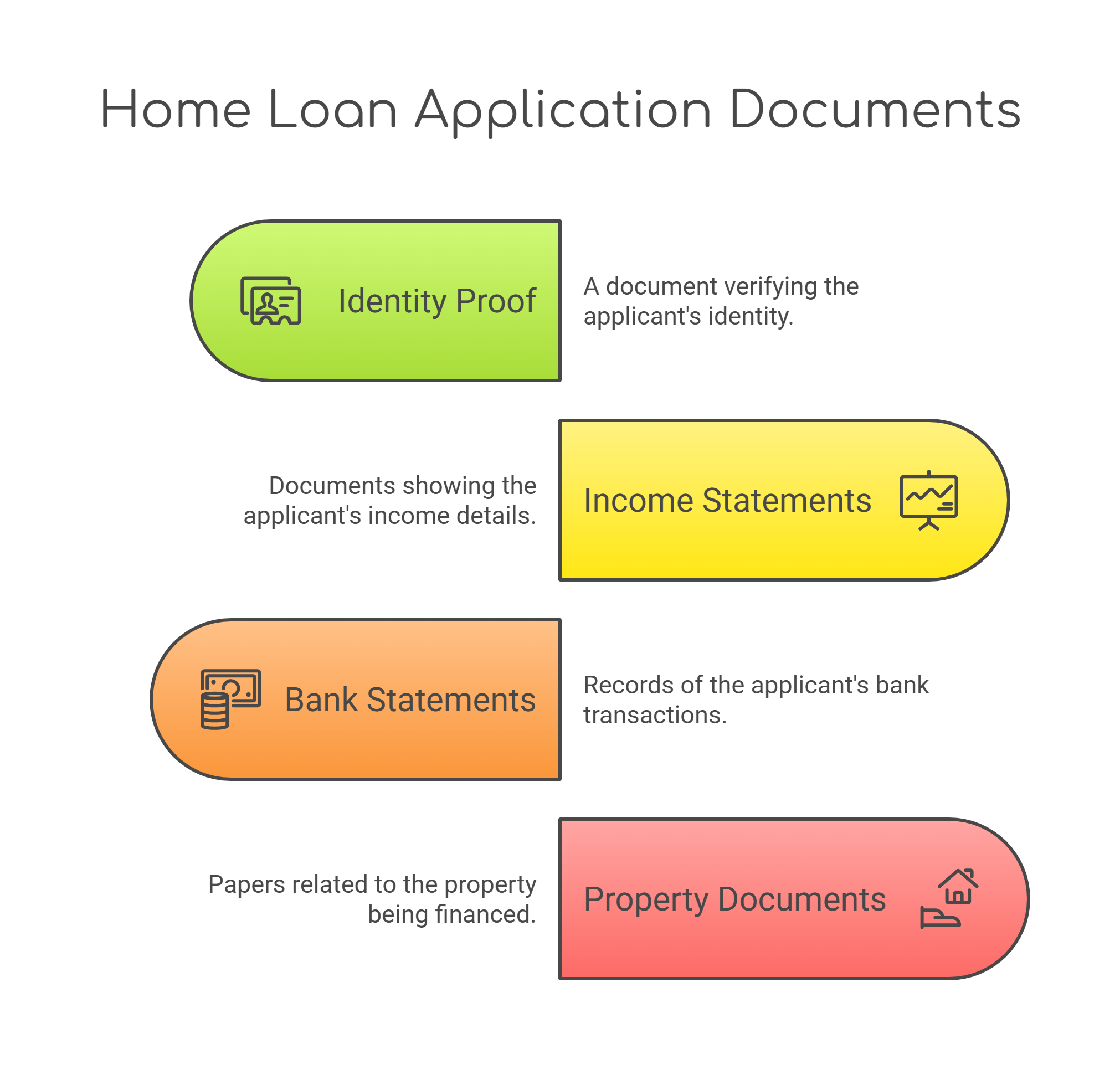

Documents required for Home Loan Eligibility in the UAE

To qualify for a home loan in the UAE, you need to submit the following essential documents :

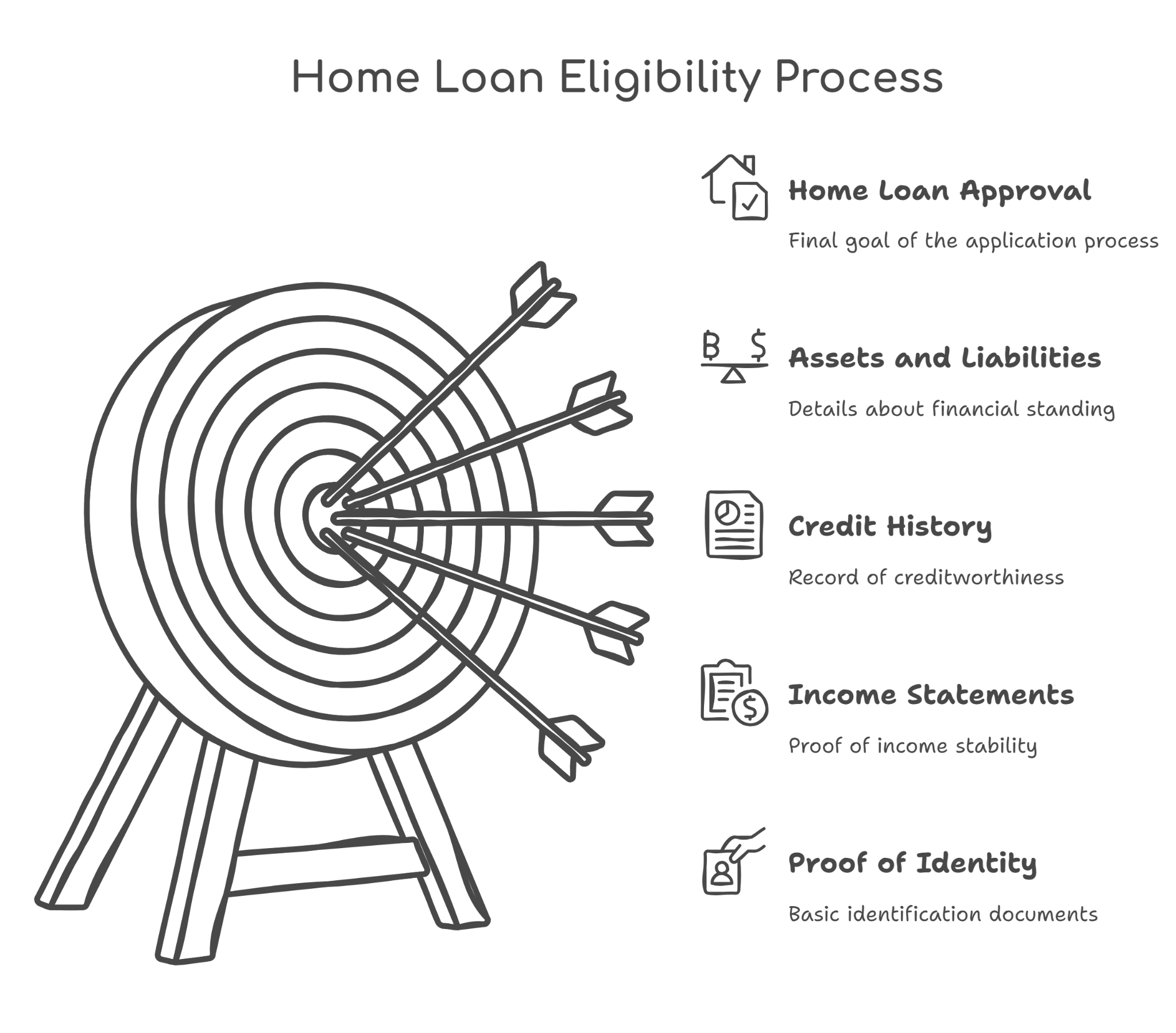

Your home loan eligibility depends on multiple factors, including your income, existing liabilities, and credit score. To determine your eligibility:

To get an estimate of how much you can borrow, many UAE banks provide a home loan eligibility calculator on their websites. These tools consider your salary, existing debts, and preferred loan tenure to give you an approximate loan amount.

By understanding these factors, you can better prepare for a home loan application and enhance your chances of securing financing for your dream home in the UAE.

How to Determine Home Loan Affordability in the UAE

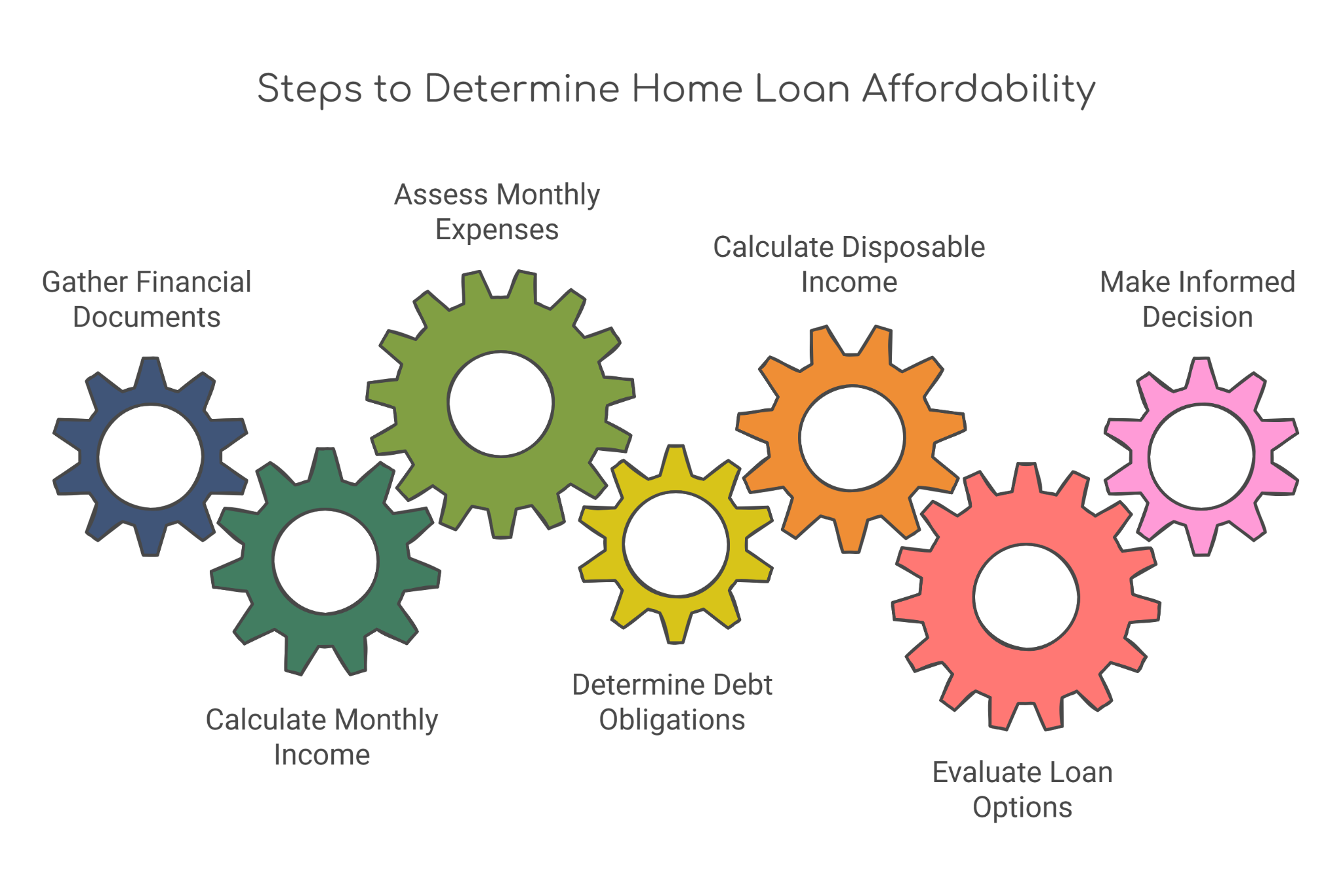

Buying a home is an exciting and significant decision. If you are a first-time buyer looking to invest a lump sum in your new home, understanding how much you can afford is crucial before applying for a home loan in the United Arab Emirates. You can get attractive mortgage options in the UAE with strict eligibility criteria. There’s a way to determine your home loan affordability, and here’s how

If you're planning to buy a property in the UAE, understanding home finance eligibility is crucial. Banks and financial institutions evaluate multiple factors, including your income, existing debts, and credit score, to determine your home loan eligibility.

The minimum salary for home loan in UAE varies among banks, but most require a fixed monthly income of at least AED 10,000 for expats and AED 8,000 for UAE nationals. Some banks may offer flexibility, but a higher salary improves your chances of approval.

To determine your home loan eligibility, follow this method:

You can use a home loan eligibility calculator to estimate the loan amount you qualify for based on your income and financial obligations. These calculators consider factors such as salary, loan tenure, interest rates, and debt commitments to provide an accurate estimate.

By understanding these factors and using a home loan eligibility calculator, you can plan your finances efficiently and improve your chances of securing a home loan in the UAE.

Enhancing Home Loan Eligibility in the UAE

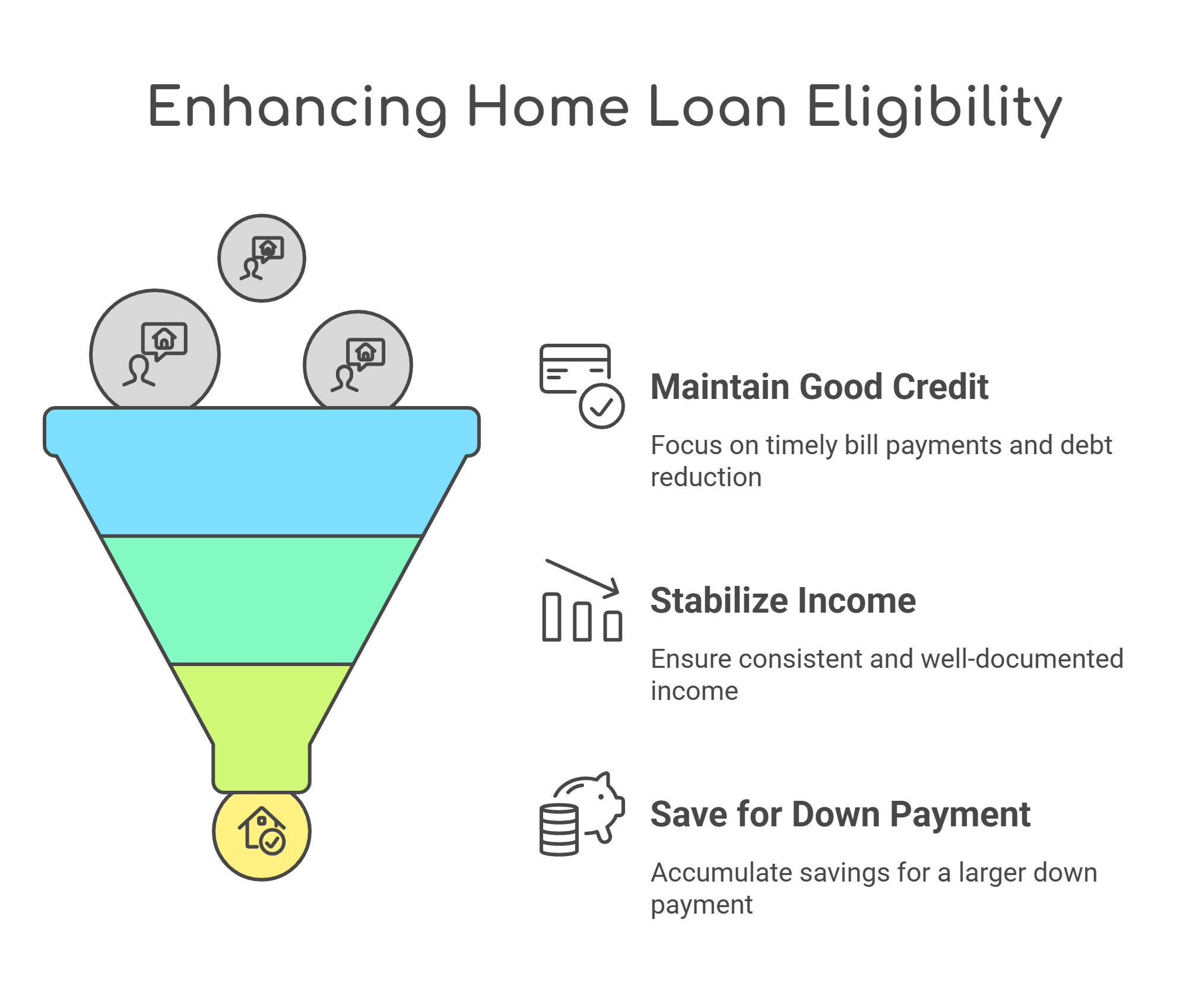

Before purchasing real estate in the UAE, it’s essential to determine your home finance eligibility. Examining your income, existing debt, down payment, and monthly expenses can help you create a realistic budget and choose a mortgage that aligns with your financial situation.

Lenders in the UAE set a minimum salary for home loan in UAE requirements, typically starting at AED 10,000 per month, though it varies by bank. Your eligibility is also influenced by your debt-to-income (DTI) ratio and credit score.

To understand how to calculate home loan eligibility, lenders assess factors such as your income, liabilities, and loan tenure. A lower DTI ratio and a higher salary improve your chances of securing a home loan.

Using an online home loan eligibility calculator can help you estimate the loan amount you qualify for. Alternatively, consulting a mortgage expert can provide insights tailored to your financial situation.

Your monthly pay and current financial responsibilities influence your eligibility for a house loan. Before approving a mortgage, lenders evaluate your income and current debt load. The 50% debt-to-income (DTI) ratio is among the most critical guidelines. This implies that your whole loan repayments should not be more than half of your monthly salary. Your prospects of getting a mortgage grow remote if your debt load is excessive.

Those wishing to purchase UAE real estate must first arrange their down payment. Expats must pay at least 20% of the home's value upfront. Hence, early saving is crucial to prevent financial stress. Comparing mortgage offers is a process that should never be omitted as loan tenures, durations, and interest rates vary among banks. A little investigation can enable you to choose the best offer for your financial circumstances.

With free online house loan calculators offered by several UAE banks, you may more easily assess your affordability. These instruments consider your income, spending, and possible loan terms to provide you with a reasonable estimate of your borrowing capability. Your first priority should be long-term financial stability. Although extending your budget for a dream house might be tempting, it is always better to select a mortgage that lets you easily handle other living expenses and monthly installments.

Most banks in the UAE require salaried employees to earn a minimum salary of AED 10,000 to AED 15,000. However, some lenders offer loans to those earning as low as AED 7,000, though these may come with higher interest rates and stricter terms.

Yes, but it can be challenging. Some banks may offer loans to applicants earning AED 7,000 or less but with higher interest rates or stricter repayment conditions. Adding a co-borrower or showing additional income sources can improve eligibility.

Yes, non-residents can apply for home loans in the UAE, but they typically need to make a larger down payment (25–50% of the property value) and may face stricter documentation requirements.

UAE residents typically need to pay a minimum of 20% of the property value as a down payment for properties under AED 5 million, while non-residents must pay at least 25%.

Key factors include income stability, employment history, credit score, debt-to-income ratio (DTI), and the loan-to-value (LTV) ratio.