Managing your personal finances efficiently starts with choosing the right bank account in the UAE. For people living in the UAE and looking for a hassle-free way to save or transact without worrying about maintaining a minimum balance, the ADCB Zero Balance Account could be a great option. It is designed to offer flexibility and ease to customers. This account allows you to enjoy banking benefits without the burden of a monthly balance requirement.

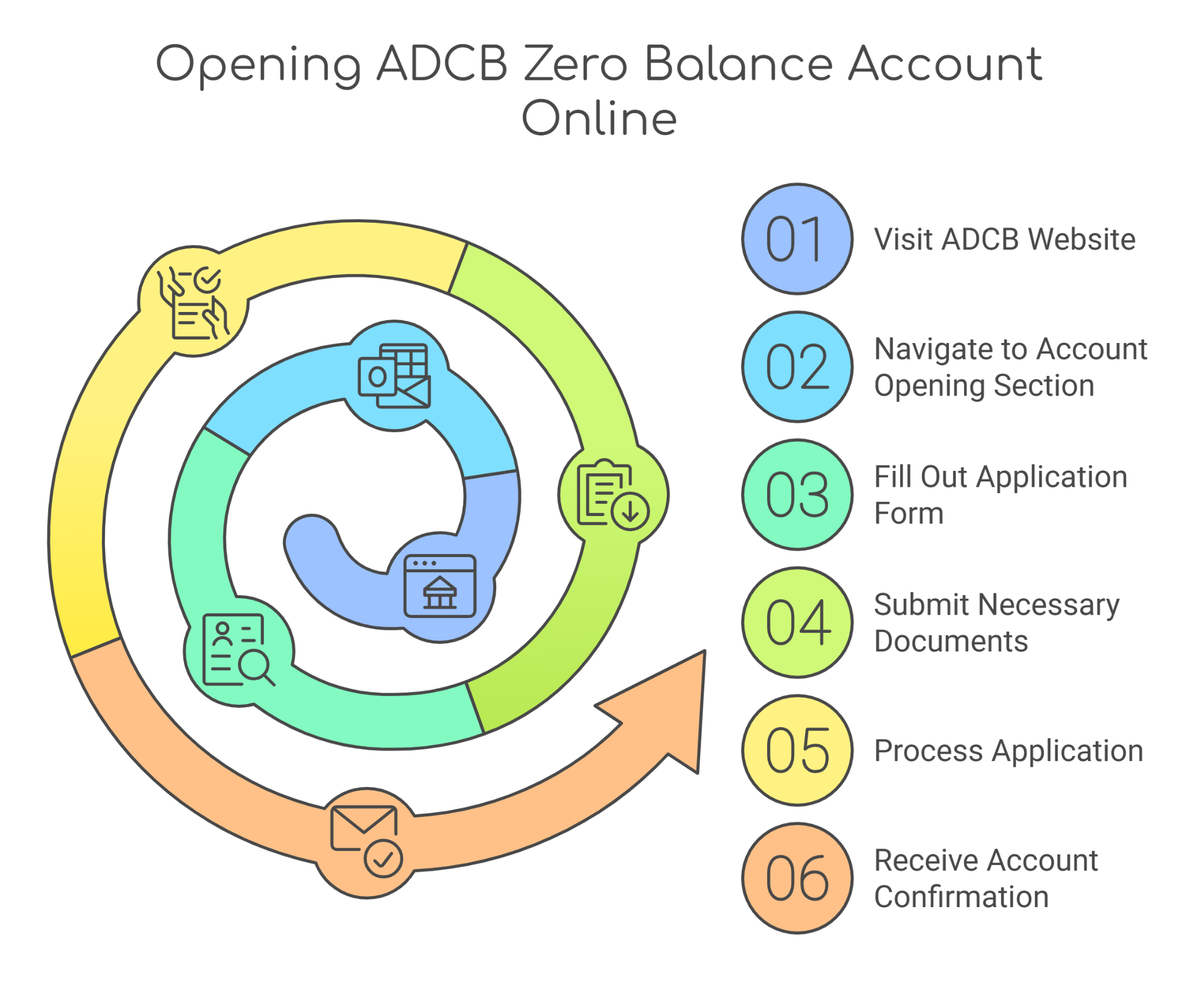

Opening an ADCB Zero Balance Account online is a comfortable process, allowing you to set up your account from the comfort of your home. The Abu Dhabi Commercial Bank is providing a seamless digital application process in the UAE. The whole process ensures quick approval and minimal paperwork. Whether you’re a salaried professional, a freelancer, or a business owner, now you can open your ADCB Zero Balance Account without the need to visit a branch in the United Arab Emirates.

Whether you are a salaried employee, a freelancer, or someone seeking a secondary bank account for everyday expenses, opening an ADCB Zero Balance account is straightforward in the UAE. This guide will walk you through the eligibility criteria, requirements, and a step-by-step application process to help you get started effortlessly.

The ADCB Zero Balance Account is generally designed for a wide range of individuals who want a flexible and cost-effective banking solution. This account is for salaried individuals, especially if you are getting a fixed salary and want a no-maintenance account. As for freelancers and self-employed professionals, managing your income can be a bit unpredictable all the time. This ADCB Zero Balance Account offers the freedom to keep your earnings in the bank without worrying about certain balance requirements.

As you relocate to the UAE, setting up a traditional bank account can be one of the first financial steps you can take. The majority of the banks require a high minimum balance, and this can be pretty challenging. This zero balance account can help you to adjust your financial commitments. This sort of Zero Balance Account is also suitable for students and entry-level employees. As any student may not have a large amount of savings to maintain a balance in his or her primary account, this ADCB Zero Balance Account will allow you to manage your hard-earned money more efficiently. This will not cost you any unnecessary bank fees and hidden charges to get better of you.

The ADCB Zero Balance Account offers more than just zero maintenance fees as it provides you with a fully digital banking experience that makes money management easier for any individual. If you prepare certain value convenience, security, and seamless transactions, then embracing ADCB’s online banking features is the smart way forward for you. Here’s the full protocol to open an ADCB Zero Balance Account :

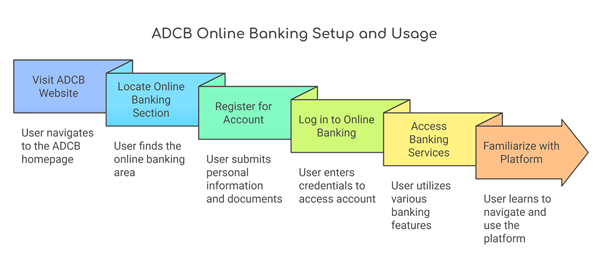

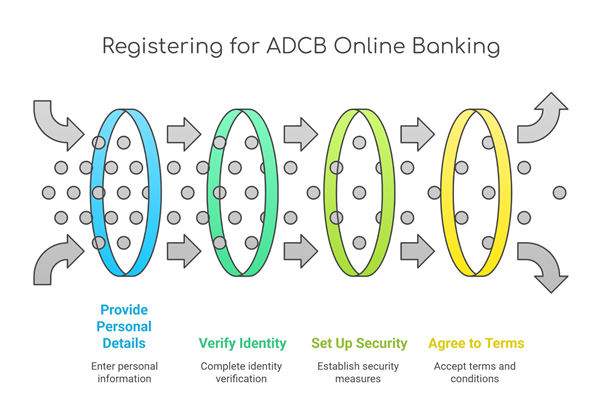

If you are relatively new to ADCB’s digital banking services, this guide will walk you through the simple steps to register, log in, and start managing your money online withing a few taps.

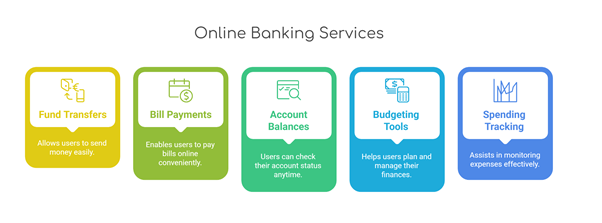

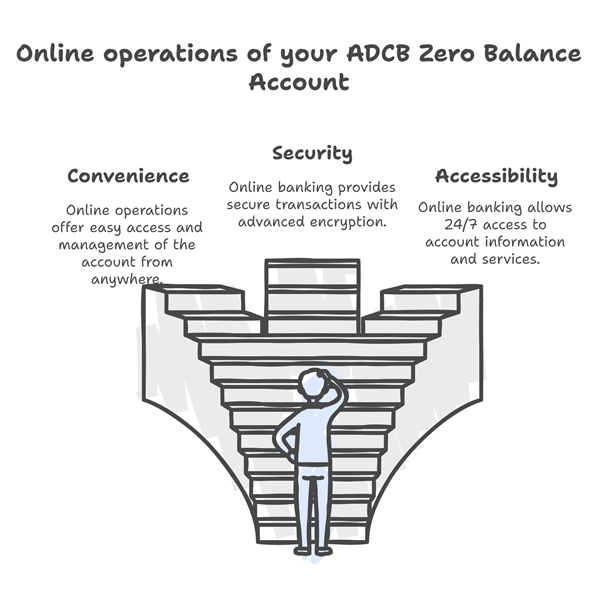

Now, you can operate multiple functions through ADCB online banking services. From paying bills to transferring funds, you can do it with fewer clicks. You can view your real-time balance and recent transactions via online banking. You can also send money within the United Arab Emirates or internationally. Paying utility bills, mobile recharges, and credit card bills is easier than ever. Opening new accounts or applying for loans are easy with online banking as you might get quicker approvals. Setting spending limits or activating and deactivating cards are accessible with ADCB Online Banking services. Having access to your ADCB Zero Balance Account summaries for tax filing or budgeting is crucial.

Having a secure banking experience is necessary as you engage with online banking with ADCB. Setting stronger passwords with complex words and characters is a plus and always keeps your password up to date. Enabling Two-Factor Authentication adds an extra layer of security to your ADCB Zero Balance Account. If you avoid using public wi-fi, it will be much more risky than using a secure network. Regularly check for unauthorised activity by monitoring your Zero Balance Account’s e-statements. Setting up your ADCB Zero Balance Account takes only a few minutes, and be aware of any phishing scams.

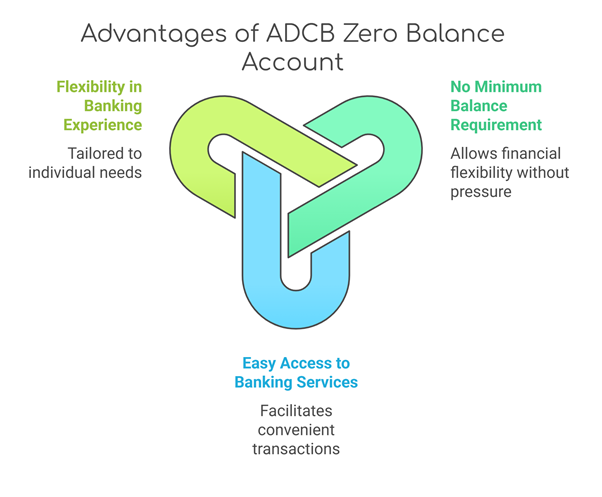

Opening an ADCB Zero Balance Account has several key advantages in the UAE. Making it an excellent choice for individuals looking for a hassle-free banking experience. A Zero Balance Account in the ADCB has several major benefits. Account holders can also enjoy bill payments, fund transfers, and other essential banking services through the ADCB mobile banking app. Here are the following benefits :

Also Read : Credit Card Eligibility in UAE

If you are considering opening an account with Abu Dhabi Commercial Bank, you may have wondered about the minimum balance requirement for their Zero Balance Account in the UAE, and there’s no minimum balance requirement. Also, there’s an option to get a Zero Balance Account in the comfort of your home. You do not have to maintain a certain amount to keep your account active.

There are no penalties for having a low balance in your ADCB account. Unlike traditional bank accounts in the UAE, there are no unnecessary deductions. Another huge benefit of having such a Zero Balance Account is that you can use your hard-earned money more freely. Get your salary credited to this account, as it is ideal for regular salary transfers. You can access your personal finances via online banking with the benefits offered by Abu Dhabi Commercial Bank.

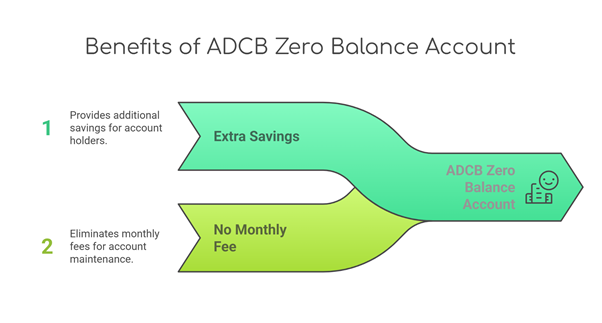

Managing your personal finances wisely is linked with choosing a bank account that offers maximum benefits with minimal costs. The ADCB Zero Balance Account is one such option in the UAE. Many banks in the UAE are offering and charging minimum balance requirements and monthly maintenance fees, which can feel like a burden after a certain period of time. This Zero Balance Account will help you to save more money with minimal balance requirements and with seamless online and mobile banking. ADCB’s digitisation makes it more accessible to anyone. You can also get free ATM withdrawals, fund transfers and debit card facilities with nominal charges.

Accessing online banking is easier than ever, thanks to online banking solutions. ADCB Zero Balance account holders are getting more convenience, security, and flexibility with online application. Operating online banking with an ADCB Zero Balance Account can be a big plus for anyone residing in the UAE. There are major benefits of having online banking as it helps you to manage your account anytime and anywhere. Access your funds without stepping into a bank. These are some benefits of having an online banking experience:

The Abudhabi Zero Balance Account is an excellent choice for anyone looking for an online banking solution without paying any extra cost. ADCB is offering no monthly fees, no minimum balance requirement for your Zero Balance Account, and fully digital banking access. This Zero Balance Account from ADCB is really beneficial for anyone in the United Arab Emirates.

Related Articles