Planning to set your financial goals right at the beginning of the year is a great way to start in 2020.

Review your financial position, check where your money goes, review your debt, cut down on extra expenses and plan efficiently. This will help you stay on savings course and prevents you from getting into any money hurdles.

Here are a few ways to help you do that:

1: Revisit your mortgage loans.

Home loans are one of the biggest financial responsibilities that require regular revisits. Look for better options to save your money or get other benefits when there is a change in your financial situations, bank’s loan terms or interest rates.

Check if refinancing can help you save money. Compare your loan interest rates with the current rates because even half of a percentage point drop will give you substantial savings.

Lower interest rates help in reducing your mortgage term because here you can raise your monthly payments and prepare to clear the loan early. For example, paying off the loan in 10 years instead of 20 years offers great savings incentive to the homebuyer.

2. Get a personal loan

A personal loan is a viable money-saving solution in many situations when you borrow it for the right reasons. With personal loans, you can settle higher interest loans, create a good credit score, pay off credit cards or consolidate debts with more manageable fixed EMIs.

For instance, when you want to consolidate debts on your different credit cards, taking a personal loan can help pay off all the charges in one monthly payment. You benefit from lower loan interest rate compared to the annual percentage rates (APRs) on your credit cards.

However, before taking a loan, calculate your repayment capacity using an online app, select repayment tenure that is within your reach and carefully review all the fine print.

3. Select the right credit card

A properly selected card can help you make savings on purchases, but the choice of the card should be based on your use and habits.

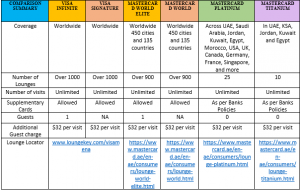

For instance, a frequent traveler will make savings when his card offers discounts and rewards on air tickets, hotels or lounge access.

The choice of the card also depends on whether you carry a balance each month or pay off dues before time. When you take forward a balance on credit, select a card that has a low annual percentage rate (APR).

Knowing your credit scores always helps you to apply for a card that is more likely to get approved. Lastly, compare the annual savings you make on the card against the card’s annual fee to see if it is right for you.

4. Find a balance transfer scheme

A balance transfer can help you make substantial money savings. Transferring high-interest debt from credit cards or loan to a card with a lower interest rate gives saving on interest and helps in clearing off the debt faster.

However, check if any balance transfer fee is levied to carry the balance to your new card. Another critical factor is the new card APR rate; check the introductory APR offer and price after the promotional period ends.

Always evaluate the terms carefully and put a debt repayment plan in place. Remember your debt doesn’t disappear when you do a balance transfer, but effective planning can help make good money savings.

5. Work out your monthly budget

Make a note of your cash flows to curb all unnecessary spending. Different apps come as a handy tool to do all the calculations for you.

Feed-in your monthly income and your expenses and the app will give you a clear picture of how to plan yourself well.

These tools help you consolidate all your bills, track the spending pattern and get an alert message when the due date of any statement is nearby to avoid late fees. Money management is a vital step to rein spending and get finances under control.

6. Review your subscriptions

If you are a Netflix and Amazon Prime addict, ask yourself if you need all these subscriptions and if you have the time to watch them?

Most people pay more on subscribing too many services but hardly use that entertainment and reading channels they have.

It’s the time to evaluate the spare time you have at hand to use these services and the cost you are spending monthly on subscribing to these. This helps you track the service you can do without and make money savings.

Besides entertainment, your current telephone and mobile plan also needs to be reviewed. Check your bills to study your usage patterns. If you are not using the full service, try considering another package. And if you are paying extra after the service amount, see if you can sign up to a new scheme that serves best to your needs.