What are the best Emirates Skywards credit cards for UAE residents?

As the world’s populace fervently hopes, we are all finally putting the nightmare of Covid 19 behind us and hopefully getting back to our pre-pandemic lives. Here in the UAE life has pretty much gone back to normal and one can’t help but notice the air of optimism of all the possibilities that now lie ahead which were a distant dream for the last two years. One of the biggies of course is that travel is back on the menu again folks! Whether it is to just go back and visit our families and loved ones or to be able to travel again as tourists and visit new destinations which was, let us admit, a favorite indulgence but almost cruelly denied to us these past 2 years.

As UAE residents we are so fortunate to have access to Emirates Airlines which is easily one of the best airlines in the world and is the obvious airline of choice when considering any international travel for us. How often do we find ourselves looking for reasons to stretch our budgets a bit to justify any price differences travelling with Emirates versus other budget airlines? Deep down we know that traveling with Emirates is quite simply the best option in terms of the entire experience – right from the dedicated terminal, class leading on demand in-flight entertainment options, direct routes saving us the hassle of multiple stops and of course for the well-heeled travelers amongst us, the Emirates business class lounge experience which is second to none!

A great option for residents and citizens to enjoy the many benefits of flying with Emirates Airlines is to use an Emirates Skywards credit card which is offered by some of the leading banks in the UAE. These credit cards are offered as a partnership between Emirates Airlines and the bank and offer a multitude of benefits to customers who have these credit cards. These benefits can vary from earning Emirates Skywards miles on purchases made with the credit cards, gaining membership to exclusive Emirates Airlines membership tiers including Skywards Silver status, and in some cases, even the coveted Skywards Gold Tier membership status. These tiers bring their own significant benefits to customers and ‘earning’ them by getting a credit card is a quick and easy way to gain entry into these exclusive membership categories. But these are just a couple of examples and as you will find out these credit cards offer a wide array of benefits to suit every individual profile.

Given the popularity and demand for flying with Emirates it is no wonder that several leading banks offer co-branded Emirates Skywards credit cards as part of their credit card portfolio offerings. And as can be expected, not all of these cards offer the same level of benefits or are indeed even offered to the same profile of customers. There are no fewer than 14 different Emirates Skywards co-branded credit cards currently available in the UAE and it is no easy task to identify which of them is best suited to you. But fret not, our team here at Soulwallet.com has done the heavy lifting to help you find the best ones suited to your specific needs.

Banks in UAE that currently offer Emirates Skywards co-branded credit cards are –

- Abu Dhabi Islamic Bank (ADIB)

- Citibank

- Dubai Islamic Bank

- Emirates Islamic Bank

- Emirate NBD

- RAKBANK

Across these 6 banks there are currently a total of 14 different Emirates Skywards credit cards offered. These are broadly categorised based on the minimum income required to be eligible for each credit card, the features and benefits offered, annual fees charged and so on.

Income Eligibility

The monthly minimum income requirement for Emirates Skywards credit cards are as below:

| Credit Card | Minimum Salary |

|---|---|

| Dubai Islamic Emirates Skywards Platinum Credit Card | AED 5,000 |

| Citi Emirates World Card | AED 12,000 |

| Emirates Islamic Skywards Signature Credit Card | AED 12,000 |

| ADIB Emirates Skywards World Card | AED 15,000 |

| Dubai Islamic Emirates Skywards Signature Credit Card | AED 15,000 |

| Emirates NBD Skywards Signature Credit Card | AED 15,000 |

| Citi Emirates Ultimate | AED 18,000 |

| RAKBANK Emirates Skywards World Elite Mastercard Credit Card | AED 20,000 |

| ADIB Emirates Skywards World Elite Card | AED 25,000 |

| Emirates Islamic Skywards Black Credit Card | AED 25,000 |

| Emirates Islamic Skywards Infinite Credit Card | AED 25,000 |

| Emirates NBD Skywards Infinite Credit Card | AED 30,000 |

| Dubai Islamic Emirates Skywards Infinite Credit Card | AED 35,000 |

| Citi Emirates Ultima Card | AED 36,750 |

As can be seen from the table above, there is an Emirates Skywards credit card option available for customers with income segments starting from as low as AED 5,000, which incidentally is also the minimum monthly salary required as per UAE Central bank regulations for a credit card.

Which is “The Best Emirates Skywards credit card” in the UAE?

While many readers would want to scroll directly to this section to find out the ‘winner’, the reality as is often the case, is that among the multitude of options available there is no single “Best Emirates Skywards credit card” for everyone. Different Emirates Skywards credit cards offer different benefits. In the sections below we will help you identify which one is the “the best Skywards credit card for you” based on your specific needs, spend patterns and priorities as an individual.

Best “PREMIUM” Emirates Skywards Credit cards

ADIB Emirates Skywards World Elite Credit Card

Emirates Islamic Skywards Black Credit Card

Citibank Emirates Ultima credit card

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

Best Emirates Skywards Credit Cards to EARN SKYWARDS MILES FROM REGULAR SPENDS

Emirates Islamic Skywards Black Credit Card

Emirates Skywards Dubai Islamic Bank Infinite Credit Card

ADIB Emirates Skywards World Elite Credit Card

Citibank Emirates Ultima credit card

Emirates NBD Skywards Infinite Credit Card

Best Emirates Skywards Credit Cards for BONUS SKYWARDS MILES

ADIB Emirates Skywards World Elite Credit Card

Emirates NBD Skywards Infinite Credit Card

Emirates Skywards Dubai Islamic Bank Infinite Credit Card

Best Emirates Skywards Credit Cards for BEST JOINING OFFERS

Citibank Emirates Ultima credit card

Citibank Emirates Ultimate credit card

Citibank Emirates World credit card

Best Emirates Skywards Credit Cards for EMIRATES SKYWARDS MEMBERSHIP TIERS

Emirates Islamic Skywards Black Credit Card

ADIB Emirates Skywards World Elite Credit Card

ADIB Emirates Skywards World Credit Card

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

Best for COMPLIMENTARY EMIRATES AIRLINES HOME CHECK-IN SERVICES:

ADIB Emirates Skywards World Elite Credit Card

ADIB Emirates Skywards World Credit Card

Best for HEALTH & FITNESS BENEFITS:

Dubai Islamic Skywards Infinite Credit Card

Best for EMIRATES SKYWARDS MILES PURCHASE DISCOUNTS

RAKBANK Emirates Skywards World Elite Credit Card

Best for CINEMA OFFERS & DISCOUNTS

Citibank Emirate Ultima credit card

Citibank Emirates Ultimate credit card

Citibank Emirates World credit card

Best for COMPLIMENTARY AIRPORT DROPS & TRANSFERS

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

ADIB Emirates Skywards World Elite Credit Card & ADIB Emirates Skywards World Credit Card

Emirates Islamic Skywards Black Credit Card

Emirates NBD Skywards Infinite Credit Card

Best to EARN EMIRATES SKYWARDS TIER MILES

Emirates Islamic Skywards Black credit card & Emirates Islamic Skywards Infinite credit card

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

Best “PREMIUM” Emirates Skywards Credit cards

ADIB Emirates Skywards World Elite Credit Card

The ADIB Emirates Skywards credit card is arguably the best premium Skywards credit card available not just for the range of benefits it offers but also being the most competitive in several key aspects. This card offers very generous Emirates Skywards miles for spends at Emirates Airlines, for international spends as well as for domestic retail spends in the UAE. In addition to the excellent Skywards miles rewards offered, this card also offers:

- 3 Emirates Skywards miles per USD of spend at Emirates Airlines, up to 2 & 1.5 Skywards miles per USD for international and domestic spends respectively

- Fast track to Skywards Gold tier membership for BOTH the primary as well as a supplementary card holder

- Complimentary Emirates Skywards Silver Tier membership

- Up to 120,000 Bonus Emirates Skywards miles (highest amongst all credit cards)

- Complimentary Emirates home check-in services (only credit card to offer this benefit)

- Complimentary airport transfers across UAE (up to 4 per year)

- Complimentary valet parking benefits at Dubai & Abu Dhabi

- Unlimited complimentary airport lounge access for each cardholder plus a guest

- Highest category of Mastercard credit cards – ‘Mastercard World Elite’ benefits & offers

Minimum Salary requirement: AED 25,000

Annual Membership Fee: AED 4,500

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Citibank Emirates Ultima credit card

The Citibank Ultima credit card is an exclusive premium credit card offering from Citi which is well known to be one of the leading credit card issuers in the world. Among other benefits this card offers the card holder the unique opportunity to hold a metal credit card. The Citibank Emirates Ultima credit card offers an extremely well-rounded feature set of good Skywards miles rewards across most categories, an excellent joining offer for customers applying online, and many other significant benefits including:

- 5 Emirates Skywards miles per USD of spend at Emirates Airlines, up to 1.5 & 1 Skywards mile(s) per USD for international and domestic spends respectively

- Complimentary Emirates Skywards Silver Tier membership

- AED 2,000 statement credit for online applications

- Credit card is made of metal (only one among all Skywards credit cards)

- Complimentary cinema offers at both VOX & Reel cinemas

- Unlimited complimentary airport lounge access for each cardholder plus a guest

- Highest category of Mastercard credit cards – ‘Mastercard World Elite’ benefits & offers

Minimum Salary requirement: AED 36,750

Annual Membership Fee: AED 3,000

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates Islamic Skywards Black Credit Card

The Emirates Islamic Skywards Black Credit Card offers premium features comparable with any other Skywards credit card offered by any bank in the UAE currently. It has the distinction of offering the highest Skywards miles earn rates across all Skywards credit cards in the UAE and also offers a host of excellent benefits including:

- 5 Emirates Skywards mile per USD of spend at Emirates Airlines, up to 2 & 1.5 Skywards miles per USD for international and domestic spends respectively

- Complimentary Emirates Skywards Silver Tier membership

- Fast track to Skywards Gold tier membership for BOTH the primary as well as a supplementary card holder

- Complimentary airport transfers across UAE (up to 4 per year)

- Complimentary valet parking benefits at Dubai & Abu Dhabi

- Unlimited complimentary airport lounge access for each cardholder plus a guest

- Highest category of Visa credit cards – ‘Visa Infinite’ benefits & offers including purchase protection, travel insurance & medical cover and so on

- 25% discount on purchase of Emirates Skywards miles

- Option to earn 1 Skywards Tier mile for every 4 Skywards miles earned

Minimum Salary requirement: AED 25,000

Annual Membership Fee: AED 4,200

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

The RAKBANK Emirates Skywards World Elite Mastercard is a premium credit card offering from RAKBANK that offers several unique benefits to card holders including:

- Opportunity to earn Skywards miles across all spend categories with a unique tier-based rewards system

- Complimentary Emirates Skywards Silver Tier membership

- Fast track to Skywards Gold tier membership by maintaining an AED 500,000 deposit in an Emirates Islamic Skywards Savings account

- Complimentary airport transfers across UAE and in India (up to 6 per year)

- Unlimited complimentary airport lounge access for each cardholder plus a guest

- Complimentary cinema offers at VOX cinemas (50% off for up to 4 tickets each month)

- 15% discount on purchase of Emirates Skywards miles

- Option to earn 1 Skywards Tier mile for every 4 Skywards miles earned

- Highest category of Mastercard credit cards – ‘Mastercard World Elite’ benefits & offers

- Complimentary Discovery Black membership

- Free petrol delivery via CAFU

Minimum Salary requirement: AED 20,000

Annual Membership Fee: AED 1,499

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Best credit cards to “EARN SKYWARDS MILES FROM REGULAR SPENDS”:

This is perhaps the most important feature to be considered for any Emirates Skywards co-branded credit card as the main purpose for a cardholder is to maximize the Skywards miles earned during regular purchases made using their credit card.

This is also an aspect where there are significant differences in earning rates and eligibility requirements between the different Emirates Skywards credit card options available. Readers are advised to review these conditions carefully before arriving at a decision on which card is best suited to their specific spend patterns.

Please note that the best credit cards identified in this category tend to be ‘premium’ credit cards as they understandably have the best rewards as well as features and benefits that the bank can offer. As such, these credit cards are likely to have higher annual membership fees. However, the benefits offered by these credit cards most often can easily justify the annual fees charged. This is especially true if the cardholder takes advantage of the specific features and benefits on offer – another reason to ensure they apply for credit cards most suited to their specific needs.

ADIB Emirates Skywards World Elite Credit Card

The ADIB Emirates Skywards credit card is arguably the best premium Skywards credit card available not just for the range of benefits it offers but also being the most competitive in several key aspects. This card offers very generous Emirates Skywards miles for spends at Emirates Airlines, for international spends as well as for domestic retail spends in the UAE. This credit card would easily have been the only choice for earning miles but for the fact that it offers lower miles earning rates on several categories.

The ADIB Emirates Skywards World Elite Credit Card awards miles per USD (equivalent) spent on the credit card as below:

- 3 Skywards miles for purchases made at Emirates online or at Emirates sales offices

- 2 Skyward miles for purchases made in foreign currencies

- 5 Skyward miles for all other local purchases

- 25 Skywards miles for these categories – supermarkets, government transactions, utilities, education, petrol stations, real estate, public transportation, Salik and charities.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates Islamic Skywards Black Credit Card

The Emirates Islamic Skywards Black Credit Card has the distinction of offering the highest Skywards miles earn rates across all Skywards credit cards in the UAE on spends at Emirates airlines and on international spends and domestic spends offers almost as many Skywards miles as the ADIB Emirates Skywards World Elite credit card. While it appears that all categories are covered under these 3 segments, there are certain categories of spends where this credit card offers much lower earn rates.

The Emirates Skywards Dubai Islamic Bank Infinite Credit Card awards miles per USD (equivalent) spent on the credit card as below:

- 5 Skywards miles for purchases made at Emirates online or at Emirates sales offices

- 2 Skyward miles for purchases made in foreign currencies

- 1.5 Skyward miles for all other local purchases

- 15 Skywards miles for spends on these categories – supermarkets, government services, utilities, education, petrol stations, real estate, insurance, car dealership, telecommunications, and quick service restaurants

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates Skywards Dubai Islamic Bank Infinite Credit Card

The Emirates Skywards Dubai Islamic Bank Infinite Credit Card is arguably the best credit card to maximise Emirates Skywards miles earnings as it offers an excellent combination of high earn rates on specific categories as well as no excluded spend categories. This is indeed a rarity as almost all other Emirates Skywards credit cards have restrictions on some segments of spend (such as groceries, utilities and so on) that have a lower earning rate.

The Emirates Skywards Dubai Islamic Bank Infinite Credit Card awards miles per USD (equivalent) spent on the credit card as below:

- 2 Skywards miles for purchases made at Emirates online or at Emirates sales offices

- 5 Skyward miles for purchases made in foreign currencies

- 1 Skyward mile for all other local purchases

- A cap of AED 25,000 on government spends per statement (which we believe is quite generous!)

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Citibank Emirates Ultima credit card

The Citibank Ultima credit card offers an attractive combination of a high earn rate along with minimal spend category restrictions. This credit card offers an even better earning rate on purchases made at Emirates as compared to the DIB Skywards Infinite above, however, it also pays a lower earnings rate on two specific categories and awards no miles on a few categories.

Emirates Skywards miles earned per USD (equivalent) spent on the card:

- 5 Skywards miles for purchases made at Emirates online or at Emirates sales offices

- 5 Skyward miles for purchases made in foreign currencies

- 1 Skyward mile for all other local purchases

- Spends at groceries/supermarkets and related to real estate will earn 0.5 Skywards miles per USD of spend.

- Spends on government services, utilities, and telecommunications do not earn any Skywards miles.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates NBD Skywards Infinite Credit Card

The Emirates NBD Skywards Infinite Credit Card is also a good option for earning Skywards Miles on regular purchases. However, this card has a few categories on which earning rates are much lower than the base rate.

Emirates Skywards miles earned per USD (equivalent) spent on the card:

- 5 Skywards miles for purchases made at Emirates online or at Emirates sales offices

- 5 Skyward miles for purchases made in foreign currencies

- 1 Skyward mile for all other local purchases

- 2 Skywards miles for spends at duty free, online food delivery and car booking apps

- 25 Skywards miles for domestic purchases relating to groceries, supermarkets, insurance, car dealership and quick service restaurants

- 1 Skywards miles for domestic purchases relating to government services, utilities, education, petrol stations, real estate, transit and telecommunication

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Best for “BONUS SKWARDS MILES”:

Several credit cards award “bonus” Emirates Skywards miles based on specific criteria, such as a minimum spend levels achieved on the credit card within a specific time period. In this category, there can be varying opinions on which is the “best” option as some cards award higher total maximum bonus miles but at the same time require higher spend levels and over shorter time periods as well. The “best” option here would be determined by the individual’s specific spend patterns.

ADIB Emirates Skywards World Elite Credit Card

Cardholders will be awarded a total of 120,000 bonus Emirates Skywards miles with this credit card which is the maximum offered by any Emirates Skywards credit card in the UAE. 50,000 welcome bonus miles are offered on payment of the membership fee, and another 70,000 Skywards miles are awarded if a total spend of AED 140,000 is met within the first 6 months of card issuance.

This credit card was chosen the winner as it has the best combination of the total bonus miles awarded and the overall minimum spend requirement over a period of 6 months. In addition, there are no specific spend category restrictions.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates NBD Skywards Infinite Credit Card

The Emirates NBD Skywards Infinite credit card offers the next best Skywards bonus miles after the ADIB Emirates Skywards World Elite credit card. Cardholders can earn up to 100,000 bonus Emirates Skywards miles:

- 35,000 “Welcome Joining Miles” on payment of the joining fee

- 40,000 additional “spend based miles” if cumulative retail spend of USD 25,000 is achieved within 3 months

- “Annual miles”: 25,000 miles will be credited if USD 7,500 is spent at Emirates (online or at sales offices) within the first 12 months

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Emirates Skywards Dubai Islamic Bank Infinite Credit Card

This credit card offers cardholders 75,000 bonus Skywards miles but requires a balance transfer of at least AED 50,000 to earn 25,000 of the total miles. Earn up to 75,000 bonus Emirates Skywards miles:

- 25,000 miles on card activation

- 25,000 miles if spend of USD 20,000 is achieved in the first 4 statements

- 25,000 on balance transfer (minimum balance transfer of AED 50,000)

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Best for “JOINING OFFERS”:

While it is usually not advisable to apply for a credit only to take advantage of a specific joining offer by the bank, it is worthwhile considering the joining offers in addition to all other benefits and features offered by the credit card.

Citibank Emirates Ultima credit card

Customers that apply online can get AED 2,000 back as a statement credit if a minimum retail spend of AED 25,000 is made within 90 days of the credit card being approved.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Citibank Emirates Ultimate credit card

Customers that apply online on Citibank UAE can get AED 800 as a statement credit if a minimum retail spend of AED 20,000 is made within 90 days of the credit card being approved.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Citibank Emirates World credit card

Customers that apply online on Citibank UAE can get AED 400 as a statement credit if a minimum retail spend of AED 10,000 is made within 90 days of the credit card being approved.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Best for “EMIRATES SKYWARDS MEMBERSHIP TIERS”:

As most readers are probably aware the Emirates Skywards Miles programme offers different “Tiers” of membership – Blue, Silver, Gold and Platinum. Each of these tiers offer different benefits to members, with the type and number of benefits increasing in that order – starting with Blue and ending with Platinum which offers the maximum benefits.

An important feature offered by some Emirates Skywards co-branded credit cards is automatic membership for the cardholder into a higher tier of the Emirates Skywards programme simply by virtue of having the credit card. This saves cardholders from having to ‘earn’ the minimum tie” miles required to be eligible for the specific tier level, obtained normally through purchase of tickets on Emirates airlines.

In this aspect as well, there are a few differences in the options available among the various Emirates Skywards credit cards. Most of these credit cards offer direct membership to the Silver Tier for the primary cardholder. A few credit cards also provide supplementary card holders the opportunity to enjoy Silver status, subject to a few conditions being met. However, only 3 credit cards offer cardholders the option to upgrade to the Gold Tier Skywards membership. This can be considered to be a significant perk of having the card by people who value the Gold membership tier in the Emirates Skywards program.

Emirates Islamic Skywards Black Credit Card

The Emirates Islamic Skywards Black Credit Card offers card holders the opportunity to fast track to Emirates Skywards Gold tier membership by simply spending AED 5,500 at Emirates Airlines within 12 months from the card issuance date. This credit card also offers one supplementary card holder the option to get Gold tier membership status by spending AED 5,500 at Emirates Airlines and payment of an annual membership fee of AED 4,000. This is the quickest option to gain Emirates Skywards Gold tier membership amongst all Skywards credit cards offered in the UAE.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

ADIB Emirates Skywards World Elite Credit Card & ADIB Emirates Skywards World Credit Card

Both Emirates Skywards credit cards offered by Abu Dhabi Islamic Bank (ADIB) offer cardholders Skywards Silver Tier membership as a basic feature of the card. However, in addition they both also offer cardholders the option to upgrade their Silver Skywards membership tier to the Gold tier if specific spend based criteria are met. Additionally, both these cards also offer the supplementary cardholder with the opportunity to upgrade to Gold tier status.

- With the ADIB Emirates Skywards World Elite credit card cardholders can get Skywards Gold Tier membership by simply spending AED 5,500 at Emirates airlines within 12 months. For the supplementary card holder, a spend of AED 200,000 (+ AED 5,500 at Emirates Airlines) within the first 12 months is required to get fast tracked to Emirates Skywards Gold Tier membership status.

- For the ADIB Emirates Skywards World credit card the primary cardholder can get Gold tier membership with a total spend of AED 150,000 and spend of AED 5,500 on Emirates within 12 months

- For the supplementary cardholder: total spend of AED 300,000 and spend of AED 5,500 on Emirates within 12 months

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

RAKBANK Emirates Skywards World Elite Mastercard Credit Card

The RAKBANK Emirates Skywards World Elite Mastercard offers cardholders Silver tier membership as a default offering. Additionally, it also offers the opportunity to fast-track to Skywards Gold tier membership based on the below criteria being met:

- Minimum spend of AED 5,500 at Emirates

- On maintenance of an average quarterly balance of AED 500,000 in the customer’s RAKBANK savings account

This credit card also offers supplementary cardholders the option to enroll in the Skywards Silver Tier membership at a fee of AED 900 per year.

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

The below Emirates Skywards credit cards all offer the primary cardholder complimentary Skywards Silver Tier membership as a benefit:

- Citibank Emirates Ultima credit card

- Dubai Islamic Emirates Skywards Infinite credit card

- Emirates Islamic Skywards Infinite credit card

- Emirates NBD Skywards Infinite credit card

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

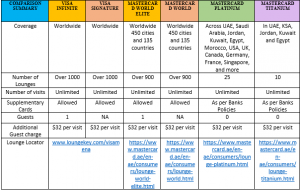

Best for “ASSOCIATION FEATURES AND BENEFITS”:

Credit card associations refer to organizations that set common transaction terms for merchants, issuing banks and acquiring banks. The associations we are referring to in our context here are Visa and Mastercard. All the Emirates Skywards credit cards issued in the UAE are either associated with Visa or Mastercard.

The relevance of this for a cardholder is that there are specific benefits and features offered by these associations to the cardholder by virtue of the partnership between the bank and the association. Similar to the different tier levels available in the Emirates Skywards miles programme, both Visa and Mastercard offer different “tiers” or levels of benefits for different credit card types.

Please note that these association features are offered in partnership with the banks and are for the most part a standard offering for the specific credit card type across all banks. Examples of these include VIP airport lounge access, travel insurance cover, car rental offers and so on. Please note that the type of benefits offered vary significantly between Visa and Mastercard.

These (Visa/Mastercard) features must not be confused with specific features offered by banks directly to their cardholders which are not part of the Visa or Mastercard benefits. Examples of such bank-specific features include complimentary valet parking, cinema tickets, airport transfer offers and so on.

Customers are advised to review closely all the features offered for each credit card to understand all the benefits available before arriving at the best credit suited to them.

Below is a categorization of the available Emirates Skywards options based on their Visa or Mastercard credit card association type:

Mastercard

- Mastercard World Elite:

This is the top-of-the-line tier of credit card benefits offered by Mastercard and are available in the following credit cards:

- ADIB Emirates Skywards World Elite credit card

- Citibank Emirates Ultimate credit card

- RAKBANK Emirates Skywards World Elite Mastercard credit card

- Mastercard World:

This is the second highest tier of credit card benefits offered by Mastercard and are available in the following credit cards:

- ADIB Emirates Skywards World credit card

- Citibank Emirates World credit card

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Visa

- Visa Infinite:

This is the top-of-the-line tier of credit card benefits offered by Visa and are available in the following credit cards:

- Citibank Emirates Ultima credit card

- Emirates Islamic Skywards Black credit card

- Dubai Islamic Emirates Skywards Infinite credit card

- Emirates Islamic Skywards Infinite credit card

- Emirates NBD Skywards Infinite credit card

- Visa Signature:

This is the second highest tier of credit card benefits offered by Visa and are available in the following credit cards:

- Dubai Islamic Emirates Skywards Signature credit card

- Emirates Islamic Skywards Signature credit card

- Emirates NBD Skywards Signature credit card

Visa Platinum:

This is the third highest tier of credit card benefits offered by Visa and are available in the following credit cards:

- Dubai Islamic Emirates Platinum credit card

All relevant features of this credit card, along with side-by-side comparisons can be seen at: www.soulwallet.com

Unique benefits available through various Emirates Skywards credit cards:

Complimentary Airport Transfers

- RAKBANK Emirates Skywards World Elite Credit Card

- Enjoy chauffeured airport pick-up or drop off service complimentary 6 times each year in the UAE or avail of this service a maximum of 3 times in India (Mumbai, Chennai, Kolkata, Bengaluru and Delhi – within city limits).

- ADIB Emirates Skywards World Elite Credit Card & ADIB Emirates Skywards World Credit Card

- 4 complimentary per year anywhere in the UAE. Value of rides capped at AED 150 in Dubai and Sharjah and AED 350 in Abu Dhabi, Al Ain and other Emirates

- Emirates Islamic Skywards Black credit card

- Take advantage of up to 4 complimentary airport transfers per calendar year to or from Dubai airport.

- Emirates NBD Skywards Infinite Credit Card

- Up to 4 complimentary airport transfers per calendar year in UAE. Only transfers within city limits, i.e. no intra-city transfers.

Cinema Discounts & Offers

- Citibank Emirate Ultima credit card, Citibank Emirates Ultimate credit card & Citibank Emirates World credit card

- Enjoy up to 4 “Buy-1-Get-1” complimentary movie tickets with VOX Cinemas each month on any day of the week.

- Up to 2 “Buy-1-Get-1” complimentary movie tickets plus 20% off food & beverage with REEL cinemas each month on any day of the week.

- (Please note both the above benefits are available only for bookings made on the Primary credit card)

- RAKBANK Emirates Skywards World Elite Credit Card

- 50% off at VOX cinemas at all times, up to 4 times each month

- Emirates Islamic Skywards Infinite credit card, Emirates Islamic Skywards Signature credit card

- Enjoy up to 3 “Buy-1-Get-1” complimentary movie tickets at REEL Cinemas each month on any day of the week.

- (Please note both the above benefits require a minimum spend of AED 3,000 per month)

Complimentary Emirates home check-in:

- ADIB Emirates Skywards World Elite Credit Card – 4 times per year for passengers traveling from Dubai.

- ADIB Emirates Skywards World Credit Card – 2 times per year for passengers traveling from Dubai.

Health & Fitness Benefits:

- Dubai Islamic Skywards Infinite Credit Card

- complimentary access to the Emirates Towers health club (and swimming pool) at any time, any day of the week.

Discounts on Emirates Skywards Miles

- RAKBANK Emirates Skywards World Elite Credit Card

- 15% discount on buying Skywards miles for self or as a gift (minimum purchase of 2,000 miles required)

Earn Emirates Skywards Tier Miles

- Emirates Islamic Skywards Black credit card, Emirates Islamic Skywards Infinite credit card & Emirates Islamic Skywards Signature credit card

- Earn 1 Skywards Tier Mile for every 4 Emirates Skywards

- RAKBANK Emirates Skywards World Elite Credit Card

- 15% discount on buying Skywards miles for self or as a gift (minimum purchase of 2,000 miles required)

We hope this article has been useful in giving you a better understanding of the various Emirates Skywards miles credit card options available in the UAE. While we have highlighted the best options for specific benefits offered by these credit cards we highly recommend that you review all the features in detail before deciding which is the best credit card for you. After all, the process of identifying the best option and applying for a credit card is not something undertaken regularly and therefore getting it right will not only help you maximise potential saves but will also help you enjoy the unique benefits most relevant to your individual preferences.

Detailed features and benefits along with side-by-side comparisons of all these credit cards and more can be found at www.soulwallet.com.