Personal loan is a type of unsecured loan that helps you meet your current financial needs. While availing for a personal loan you don’t require collateral or a need to pledge any security, and personal loans are also generally quickly disbursed. Personal loans can serve as a solution for managing a number of your needs, such as, expenses for higher education, medical emergency, holidays, wedding celebrations, to expand one’s business, and other needs.

Over the years due to instant financial availability and easy accessibility, personal loans have become tremendously popular amongst professionals as well as for personal finance. However, just like any other loan, you must repay it accordance to the agreed terms with the bank from where the loan was borrowed from. Some of the most important factors that you need to consider before availing a personal loan are the interest rates, repayment capacity, and the tenure of the loan.

Calculating personal loan EMI manually or making do with speculations could be inefficient or more often that result in an incorrect value. Hence it is preferable to opt for the personal loan EMI calculator to consider your suitability to take out a personal loan before applying for one.

What is a Personal Loan EMI Calculator?

Whenever you take up a personal loan, you have to pay back to the bank the principal amount along with the interest amount that is calculated every month. EMI stands for Equated Monthly Instalment. A personal loan EMI Calculator is a tool that helps you to evaluate and calculate the amount that has to be paid every month for your personal loan.

It is advisable to check the amount with an EMI calculator before applying for a personal loan as you would be aware of the monthly amount that you need to repay during your tenure. This in turn would help you determining how a personal loan might affect your monthly expenses and lifestyle and help you understand and manage your monthly financial goals.

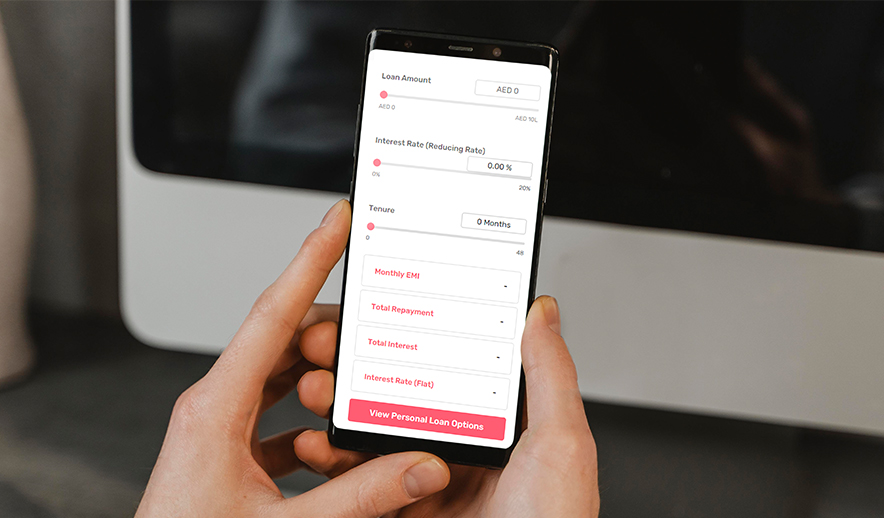

Calculating the EMI for your personal loan is an incredibly simple process. See how much you can save by choosing right Personal Loan with the help of SoulWallet’s Personal Loan EMI Calculator.

How Does the Personal Loan EMI Calculator Work?

EMI calculator is a simple and very easy to use tool that does the calculations for you to calculate your loan. The personal loan EMI is based on some parameters such as the amount borrowed and the interest rate that is applicable based on your loan tenure. The first thing you enter is the principal amount that you wish to take out through your personal loan. Next, you put in the duration of your loan, which is the period of time you’d be allowed to repay your personal loan. And finally, the calculator needs to take into account the interest rate being charged, which is a percentage of the principal amount you have to repay.

After you put in all the required information, the personal loan EMI calculator would calculate and provide you with the EMI amount. The tool is available anytime and without any costs for you to choose a loan best suitable for you.

Factors affecting Your EMI Amount

Some of the factors that can affect your EMI amount are:

- Loan amount – The higher amount of loan you borrow the high would be the monthly instalment. In this, the interest rate and tenure remain constant.

- Interest rate – If your interest rate is high then you need to pay a high amount of monthly instalment.

- Tenure – If the tenure is for long period the monthly instalment would be low, but this would lead to a high amount of interest rate as compared to a shorter tenure of the loan.

Benefits of a Personal Loan EMI Calculator

It is advisable that you use a personal loan EMI calculator before you apply for a personal loan.

Some of the key benefits that one would experience with this calculator are:

- Fit in the EMI with necessary changes in the monthly budget: When you calculate the personal loan EMI, you know the fixed amount that you would have to pay every month till the end of the loan tenure. This would help you decide and budget your monthly expenditure throughout the loan tenure with ease.

- Make decisions by changing the factors affecting the EMI: The loan amount, along with the monthly interest rate, and tenure play a very significant role in determining your EMI. The EMI is directly proportional to the loan amount and interest rate and is inversely proportional to the tenure of the loan. Hence, if you choose a longer tenure, then the monthly instalments would be small. The EMI calculator would help you differentiate different loan amounts with their tenures and interest rates. Thus, making it easy and convenient for you to decide the amount of loan that would suite your lifestyle and finances.

- Ensure a healthy credit rating: When you have calculated the EMI before taking up the personal loan, you are completely prepared to manage your finances for repaying the loan in the given time. Which would result in you not missing out on the EMIs, and thus avoid a poor credit rating for you.

- Saves time and provide accurate results: It takes a lot of time, efforts, and complicated calculations to calculate EMI’s manually. All these calculations are performed within seconds with the personal loan EMI calculator, thus saving you lot of time. Also, the chances of errors when the calculations are done manually are eradicated and you would be getting accurate results.

- Easy to use and access: The Personal loan EMI calculator is available online on SoulWallet and it is pretty easy to use. All you need to do is enter the principal amount of the loan, interest rate, and the tenure of the loan to get the value of monthly instalments that you would have to pay. This makes it very easy for the users to calculate the monthly instalment from any place and at any time.

There are plenty of advantages of using an EMI Calculator before applying for your Personal Loans in UAE. The use of an EMI calculator helps your eligibility to avail a personal loan and repayment capabilities and ensures your financial wellbeing. SoulWallet helps you See how much you can save by choosing right Personal Loan with the help of Personal Loan EMI Calculator for you to have an easy and hassle-free experience.

The well-researched, solidly structured, unbiased content along with unique tools at SoulWallet help you make well informed financial decisions for your personal and business transactions. In the process, SoulWallet helps you identify the options that will let you save money and enjoy the best perks.

SoulWallet grants their users services that would help them make the most of a wide range of personal finance solutions, from credit card reward cards in the UAE, to personal loans, to Islamic credit cards, to air miles credit card application and a lot more.